Offer Profile

The offer profile page presents detailed information about each offer. All configurations set when creating the offer will be found here.

This profile has three different tabs providing you with detailed information. These tabs are General Settings, Repayment logics, and Charges in order of collection priority. Also, you can simulate an offer here.

Enabling/disabling an offer

In the offer respective page, you are able to disable or enable the offer by setting the desired option on the top-right corner of the screen.

General settings

The General Settings tab presents you with the following information regarding the respective offer:

- Maximum number of the active credits: The maximum number of active credits for the respective offer. It may be limitless.

- Offer documents: A PDF file with all information regarding the offer.

Repayment logics

Repayment logic is a complex set of rules determining how repayments are calculated and handled. Each component of Repayment Logic is crucial in shaping the financial aspects of the credit offer. It is essential to understand each configuration option to ensure that the repayment logic perfectly matches your business objectives, regulatory obligations, and the individual financial circumstances of your users. Below are descriptions of each available configuration option:

| Setting | Setting description |

|---|---|

| Repayment type | How the credit will be repaid. Can be installments or sales discounts. |

| Periodicity | Frequency in which the customer must repay the obligation. This setup is used to calculate the term of the credit. |

| Calendar logic | Whether repayments for this offer can be issued on business days only or on any calendar day. |

| Min - Max amount | The minimum and maximum value allowed for the offer. |

| Fixed or Relative | Whether payments are issued on a fixed day or relative to the exact disbursement date. |

| Type of installment | The installment type selected when creating the offer. |

| Missed repayment logic | In case of a missed payment, how the unpaid amount is paid. |

| Grace period | Whether the credit allows a grace period before defaulting on installments. |

Charges in order of collection priority

The Charges tab presents the personalized financial aspects of the offer. The adjusted interest rates, customized costs associated with certain transactions or activities, such as withdrawal fees or overdraft fees, to better align with your business needs.

Additionally, you find the collection costs incurred in the event of a delinquent account, such as the cost of a collection agency or legal fees. Furthermore, you can see the default interest rate applied when a loan or credit repayment is overdue, ensuring that late payments do not financially impact your company.

Interest

| Setting | Setting description |

|---|---|

| Interest value | The annual interest rate to calculate the interest for this credit offer. |

| Base | Whether interest is calculated on total or capital balance. |

| Tax | If regulations apply, the interest tax included. |

| Periodicity | Frequency that determines the accrual of interests. |

| Grace Period | If this credit will allow a flexible time period before interest default measure takes place. |

Costs

| Setting | Setting description |

|---|---|

| Fixed or percent | Whether this cost is a fixed amount or percentual amount. |

| Tax | If regulations apply, the tax included for this cost. |

| Type |

Collection costs

| Setting | Setting description |

|---|---|

| Trigger | When the collection cost will be triggered. |

| Grace period | Whether this credit allows a flexible time period before collection costs trigger activates. |

| Fixed or percent | Whether this collection cost is a fixed amount or percentual amount. |

| Tax | If regulations apply, the tax included for this collection cost. |

Default interest

| Setting | Setting description |

|---|---|

| Trigger | When the default interest will be triggered. |

| Interest value | The annual interest rate to calculate the default interest for this credit offer. |

| Base | Whether the default interest is calculated on total or capital balance. |

| Tax | If regulations apply, the tax included for this collection cost. |

| Periodicity | Frequency that determines the accrual of the default interest. |

| Fixed or percent | Whether the default interest is a fixed amount or percentual amount. |

| Grace period | Whether this credit allows a flexible time period before the default interest trigger activates. |

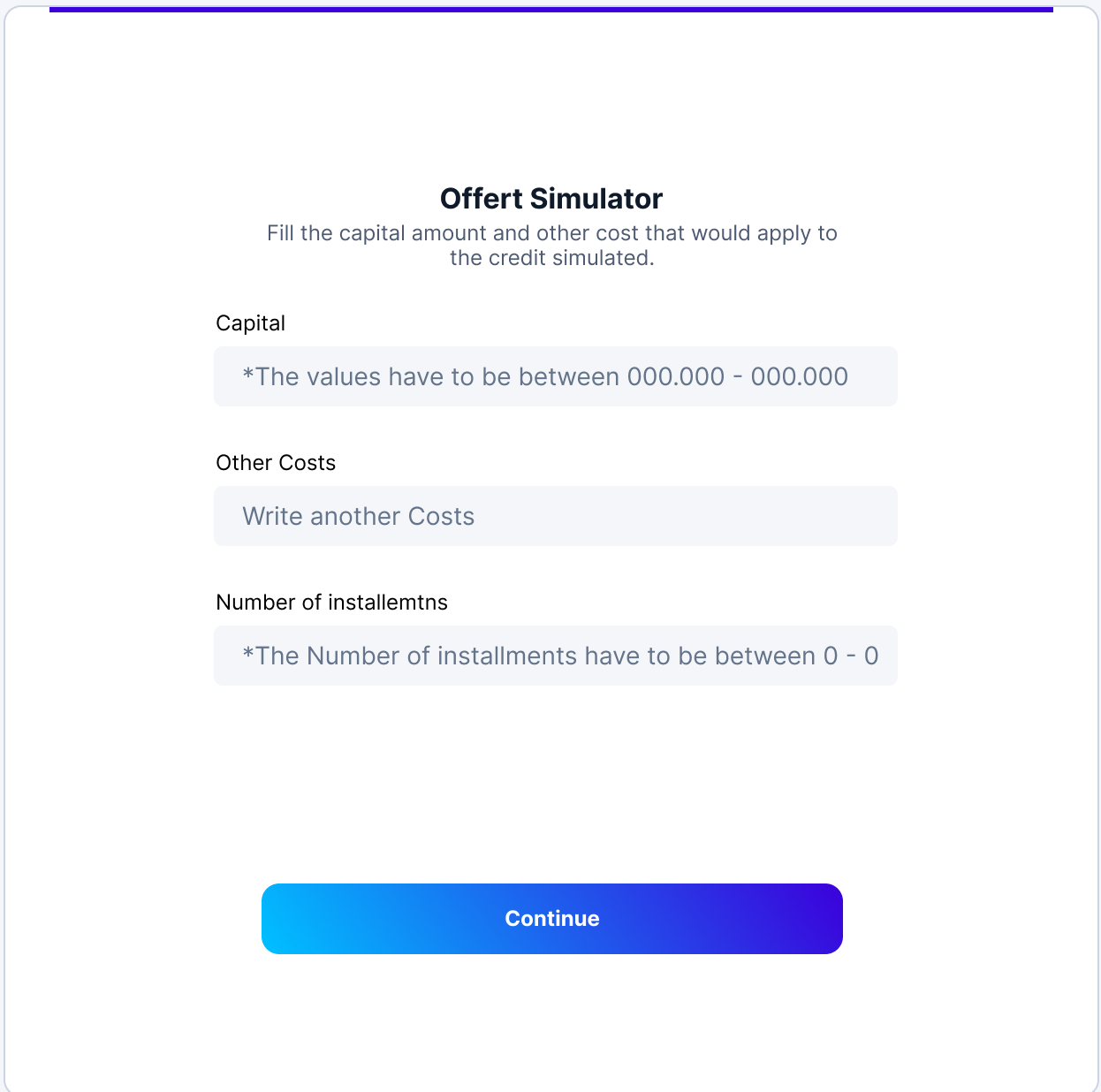

Offer Simulator

MO allows you to simulate each offer directly from the Admin Portal. By accessing the offer's profile page, you need to do the following:

- Click the Simulate offer button at the top-right corner of the screen.

- Enter the required information to simulate your offer:

- Capital: The capital amount to be requested at this loan simulation.

- Other costs: Any desired costs to be added to the offer.

- Number of installments: The number of installments in which the loaned amount must be paid back.

- Click Continue.

- Done!

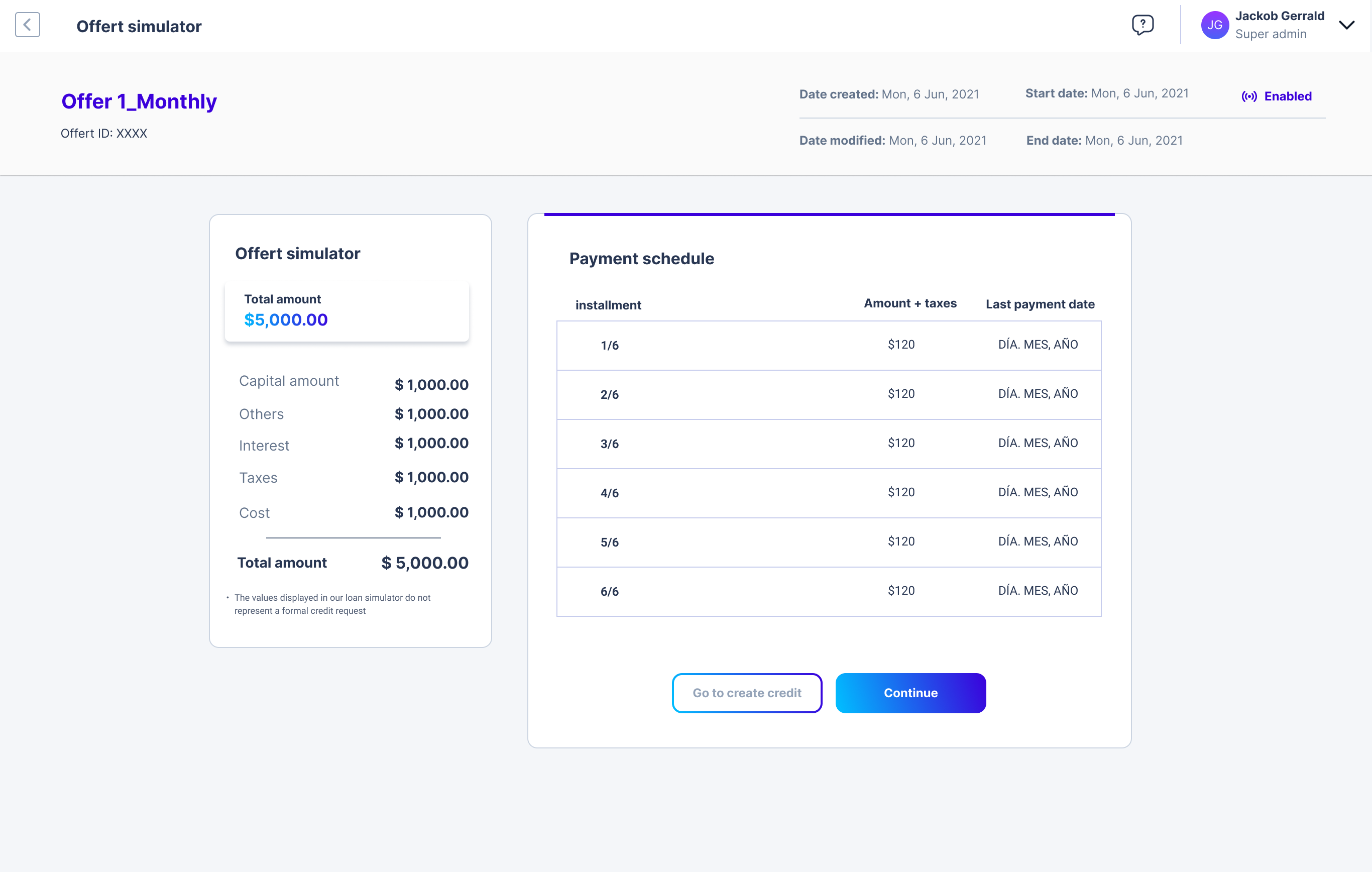

MO's Admin Portal will present you with the offer simulation details page, with the following details:

- Total amount: The total value of the simulated offer, containing the following values:

- Capital amount: The capital value to be loaned.

- Others: Any other costs added when simulating the offer.

- Interest: The total of interests regarding the amount to be loaned.

- Taxes: The total taxes regarding the amount to be loaned.

- Cost: The total costs regarding the amount to be loaned.

- Payment schedule: The detailed information of each installment that should be paid, with the amount of each and their respective due dates.

The image below exemplifies the simulated offer.

a

Updated 6 months ago