Aggregator Manager

MO's system includes Aggregators that act as a supplementary entity in the credit operation. These Aggregators work as groups of end-users, and they issue credits to other groups of end-users. Whenever these credits are issued through Aggregators, a commission is charged in favor of the funder as compensation for their funding service or credit issuance.

BNPL-type businesses are an excellent example of such Aggregators. They issue credits to their buyers through businesses that accept the BNPL payment method. The Aggregators associated with the credit operation have access to a dedicated portal where they can view all the credits issued through their particular operation and the commissions between them and the funder.

This section presents you with five sub-sections, those being Aggregator, Aggregator's credits, Payouts, Movements and Aggregator groups.

Aggregator

The Aggregator sub-section displays a table listing all your current aggregators, providing you with an overview of them. The table presents the following information:

| Field | Description |

|---|---|

| Aggregator ID | Unique identifier of the merchant issuing credits. |

| National ID | Identifier of the user in the country (Ruc, Nit). |

| Aggregator | The name under which the merchant was created. |

| Aggregator Group | Group to which the aggregator belongs, defining which offers the merchant will show. |

| Status | Status of the trade for issuing credits. |

| Date Created | Date the trade was created on the platform. |

Aggregator details

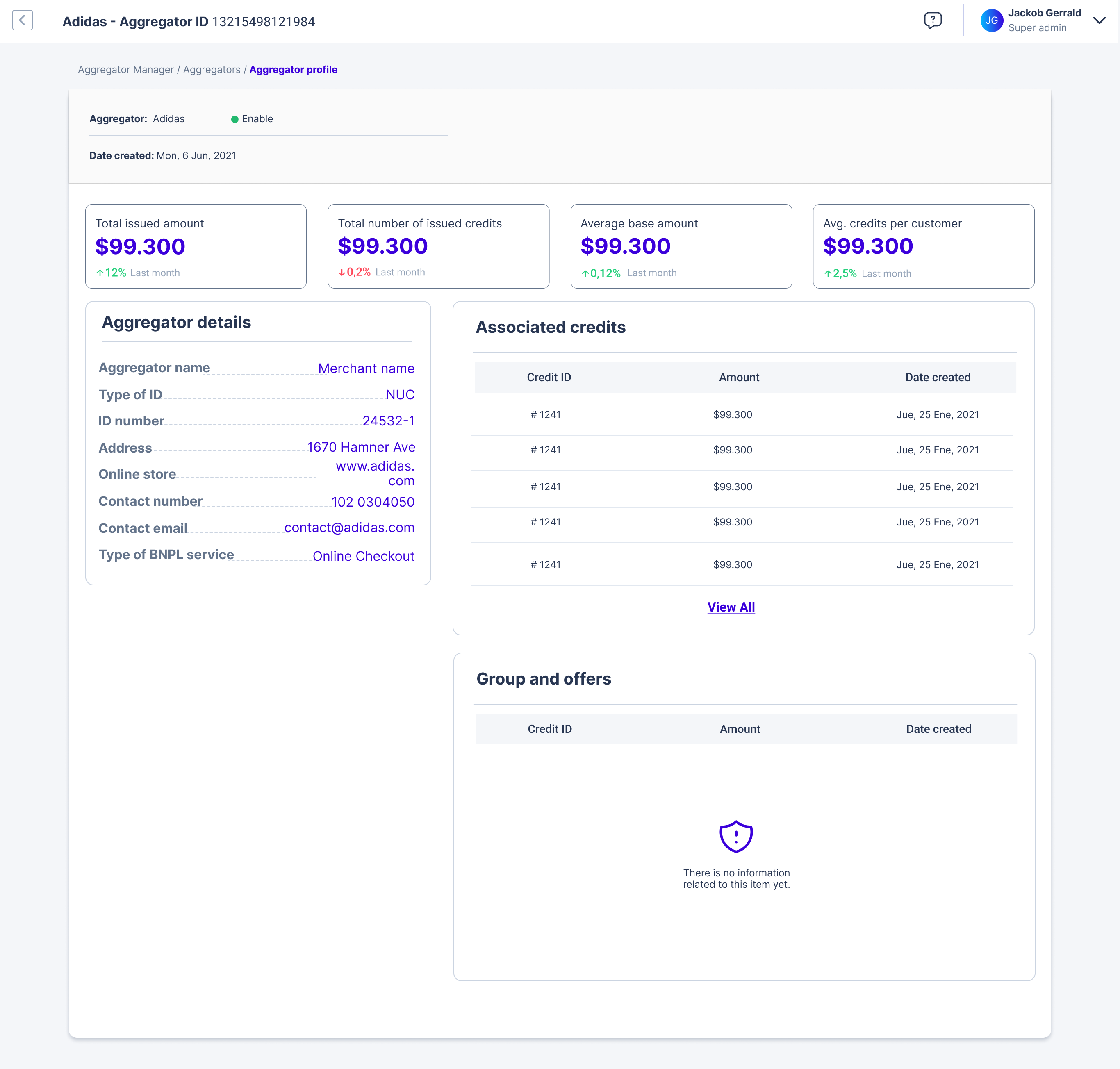

You will be redirected to their details page by clicking on any aggregator. Here, you are presented with all information related to the respective merchant, such as:

- Summary: Trade information includes the total amount and number of issued loans, average base amount, and loans per client. The last month's variation is shown at the bottom.

- Aggregator details: Trade information such as the name of the aggregator, type of ID, ID number, contact phone number, and email address.

- Associated credits: Recent associated credits for the aggregator: credit ID, amount, and creation date. You can access the credits section by clicking the View All button.

- Groups and offers: This section contains information about the merchant's group memberships and available offers. You can click the View All button to see the merchant's groups.

The image below shows an example of this page:

Aggregator´s Credits

In the Aggregator's Credits sub-section, you can view the total number of credits earned by the aggregator during its operation and recorded on the platform. It presents an overview with details of each credit, with the following information:

| Field | Description |

|---|---|

| Aggregator Credit ID | Unique identifier of a purchase made in a store. |

| Aggregator ID | Unique identifier of a merchant on the platform. |

| Customer ID | Unique identifier of the user on the platform. |

| National ID | Identifier of the user's document in the country of origin. |

| Customer Name | The name captured in the user's onboarding process. |

| Base Amount | Capital value of the credit made by the aggregator. |

| Down Payment | Down payment value paid by the user. |

| Credit ID | Unique identifier of the credit issued for the sale made by the merchant. |

| Status | Status of the purchase (Captured, returned, and rejected). |

| Date Created | Date of sale. |

Payouts

The Payouts section summarizes all the payouts that should be paid to your Aggregators. Whenever an Aggregator generates loans using your business as the loan source, it will be recorded as a new movement.

When you transfer money from your business to an Aggregator as a loan for their client, this amount is considered as a Payout. The Payouts are the total accumulated amount that should be paid to the Aggregator, based on the frequency you have specified, taking into account the amount of loans processed during the defined period and the commission paid by the Aggregator.

The overview table of the payouts presents you with the following information about each payout:

| Field | Description |

|---|---|

| Date | Date of the transaction. |

| Payout ID | Unique identifier of a payout. |

| Aggregator ID | Unique identifier of the merchant on the platform. |

| Aggregator | Name of the merchant on the platform. |

| Aggregator Group | Group to which the aggregator belongs. |

| Total Amount | Total amount of the transaction. |

Movements

In the Movements sub-section, you can view the total number of trade movements and transactions that have taken place up until the present time. You can search for specific transactions by payment ID, filter them by date, and by type of movement. Additionally, you will see a search button, a download button, and a table of payment information. The fields of each movement presented in this table are:

| Field | Description |

|---|---|

| Date Created | The date the transaction was made for a purchase or a return. |

| Aggregator Credit ID | Unique identifier of the purchase in the platform. |

| Aggregator ID | Unique identifier of the merchant on the platform. |

| Aggregator | Name of the merchant in the platform. |

| Payout ID | Unique identifier of a settlement on the portal. |

| Amount | Total purchase amount. |

| Transaction Amount | Total amount of the transaction to be added to or subtracted from settlements. |

| Tax | Amount of tax applicable to the commission charged by the client to the merchant. |

| Type | Indicates the type of movement if it adds or subtracts to the merchant's settlement (e.g., addition, subtraction). |

Aggregator Groups

Our system supports Aggregators being grouped into different sets, allowing offers to be segmented. Access the Aggregator Groups page to learn how to manage your groups efficiently.

Updated 6 months ago